🎉12 Days of B&W Finance - Day 8🎉

Exclusivity – In our modern world we crave it, whether it be getting let into the VIP room at a nightclub to getting an online coupon for your birthday and everything in between.

Even Christmas is the same, everyone wants to be on that exclusive nice list, right?

Today on day 8 of our 12-day coverage we’ll be talking about industry specialisation and what it could potentially mean for your future finances.

"On the eighth day of Christmas, Black and White Finance gave to me: Eight specialist loans,

- Seven tips for auction,

- Six low deposits,

- Five lenders lending,

- Four guarantors,

- Three construction loans,

- Two different rate options,

- And a head start on my first home"

What is industry specialisation?

It’s probably one of the finance world's worst kept secrets but in case you’ve never heard about it, industry specialisation offers considerable savings for individuals applying for a loan who fall under specific occupational roles.

Of course, each lender has a different idea of what they consider to be an industry specialist, but if you’re lucky enough to count yourself as part of this exclusive list you may find benefits such as discounted interest rates and the waiving of LMI (see day 5).

Accountants, lawyers and medical professionals, oh my!

So surely by now you’re wondering, “Do I qualify for these awesome benefits?” and the answer to that is… maybe.

You see, because each lender has different requirements for who is included and are constantly changing their policies it is hard to generalise.

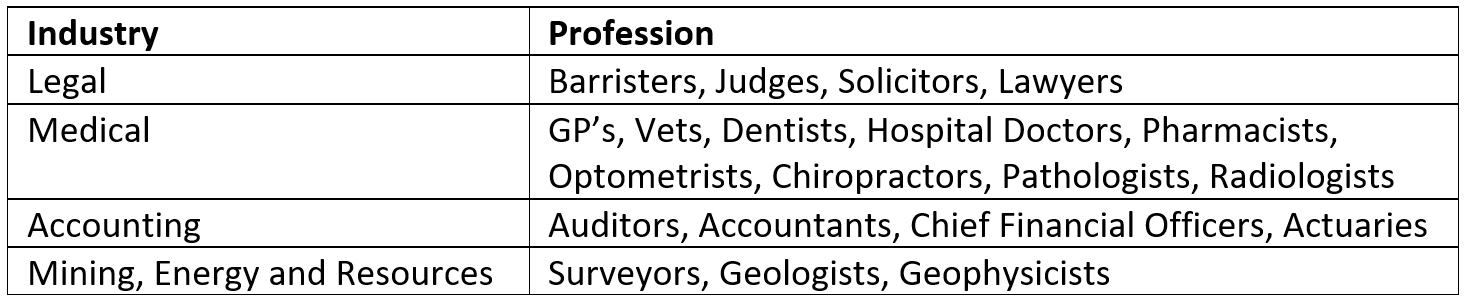

Suffice to say, however, that if you count yourself amongst any of the following professions you should definitely make further inquiries with your broker.

You can’t sit with us!

There are a few more key notes to take away with you before you start singing on the rooftops about industry specialisation, namely some requirements to tell if you’re eligible and what you have (or don’t have) to provide to your chosen lender.

You must;

Have a permanent residency or citizenship within Australia.

Have a minimum annual income of $120,000.

Provide evidence of industry work in the form of a practicing certificate/ diploma for your relevant state.

Otherwise;

No evidence of genuine savings needs to be provided.

Can get LMI fees waived up to 90% LVR.

Can get a favourable discount on interest rates for specific approved lending products.

Final Thoughts

Industry specialisation is an interesting topic, you can see it as lenders hedging their bets on low-risk applicants.

Even though not everyone can qualify, if you meet the above strict criteria and policies, it is in your best interests to seek professional aid in the form of a broker who can tell you all the in’s and out’s of how this affects your specific circumstance.

It is more so designed for professionals who will always have a demand for their services, hence the low risk of them not meeting serviceability.

I say if you’ve got it you may as well reap the rewards, right?

Reach out to us today

0448 890 186

or

Feedback

We’d love to hear what you think about our content.

We’re also keen to receive your questions and if you want to know of some other great terms or rates on offer at the moment, and would rather email, please send a note to peter@blackandwhitefinance.com.au

* Your full financial situation would need to be reviewed prior to any acceptance of any offer or product. Subject to lenders terms and conditions, fees and charges and eligibility criteria.