Rate Forecasts To Consider and Housing Trends

As we move into the final quarter of 2024, interest rates remain a hot topic. This month, we explore key shifts in fixed rates and the likelihood of variable rate cuts off the back of last week’s employment data. We also take a look at the movements in our housing market after hearing Corelogic’s Tim Lawless, present to us live last week. We look at the last 12 months, the slowing pace of growth, and explore the increased diversity in house prices across the country.

Employment Figures Too Strong for Rate Cuts in 2024

Despite hopes for rate cuts in 2024, the Australian economy isn’t cooling fast enough. September's employment figures hit a 16-month high, with workforce participation reaching record levels and unemployment staying low at 4.1 per cent, according to the Australian Bureau of Statistics (ABS). The addition of 64,000 jobs, far exceeding the 25,000 predicted by economists, has kept the labour market tight, making it unlikely we’ll see any cuts to variable rates this year.

Economists at AMP and ANZ suggest this strong labour market indicates the economy’s lack of spare capacity, reinforcing predictions that the RBA will hold off on rate cuts until February 2025.

Fixed Rate Swings: Macquarie’s Moves Reflect Market Uncertainty

Before the latest employment data was released, money markets had been pricing in earlier rate cuts. In response, Macquarie Bank first lowered, then quickly raised, its fixed rates, reflecting the volatile nature of the current economic landscape. Such fluctuations highlight how quickly lenders react to changes, making it critical for borrowers to stay informed.

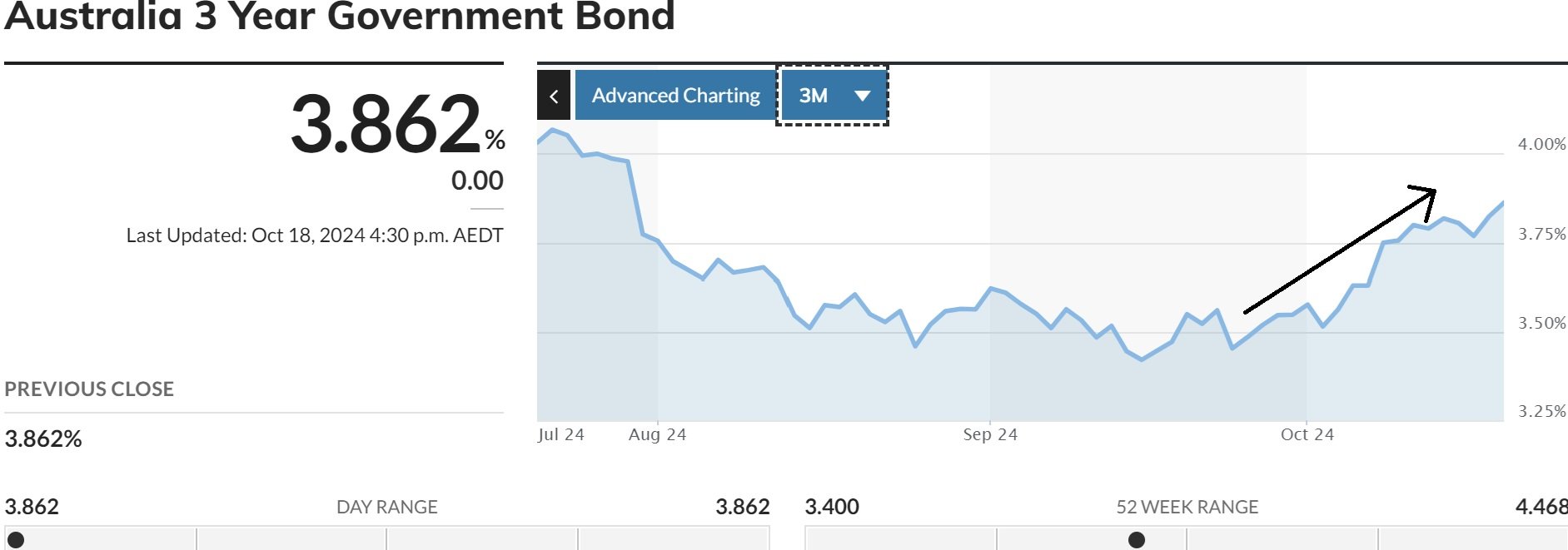

See here the recent change in the bond yield curve, which determines the fixed rates our banks offer:

If you’re considering fixing your rate, timing is everything. These fixed rate swings, when bank’s offer lower fixed rates off the back of money market swings have happened before, so approach any decision to fix carefully.

Is Fixing Worth It Now? The Gamble on Rate Cuts

With variable rate cuts expected in the next 12 months, typically 0.25 per cent at a time, fixing your rate now means betting that there won’t be more than three rate cuts or so, over the next two years. This is because variable rates for principal and interest, owner occupied loans sit at around 6.09 per cent or so, and in comparison, some of the best 2 year fixed rates for this same loan type, are hovering at around 5.74 per cent. That’s a significant gamble, especially given rates are expected to drop as of February next year. We touched on this strategic thinking in last month's update too.

While fixing provides repayment certainty, it could mean missing out on future rate drops. A balanced approach fixing part of your loan and keeping the rest variable, might give you the best of both worlds.

Housing Values: Growth Slows, Diversity Increases

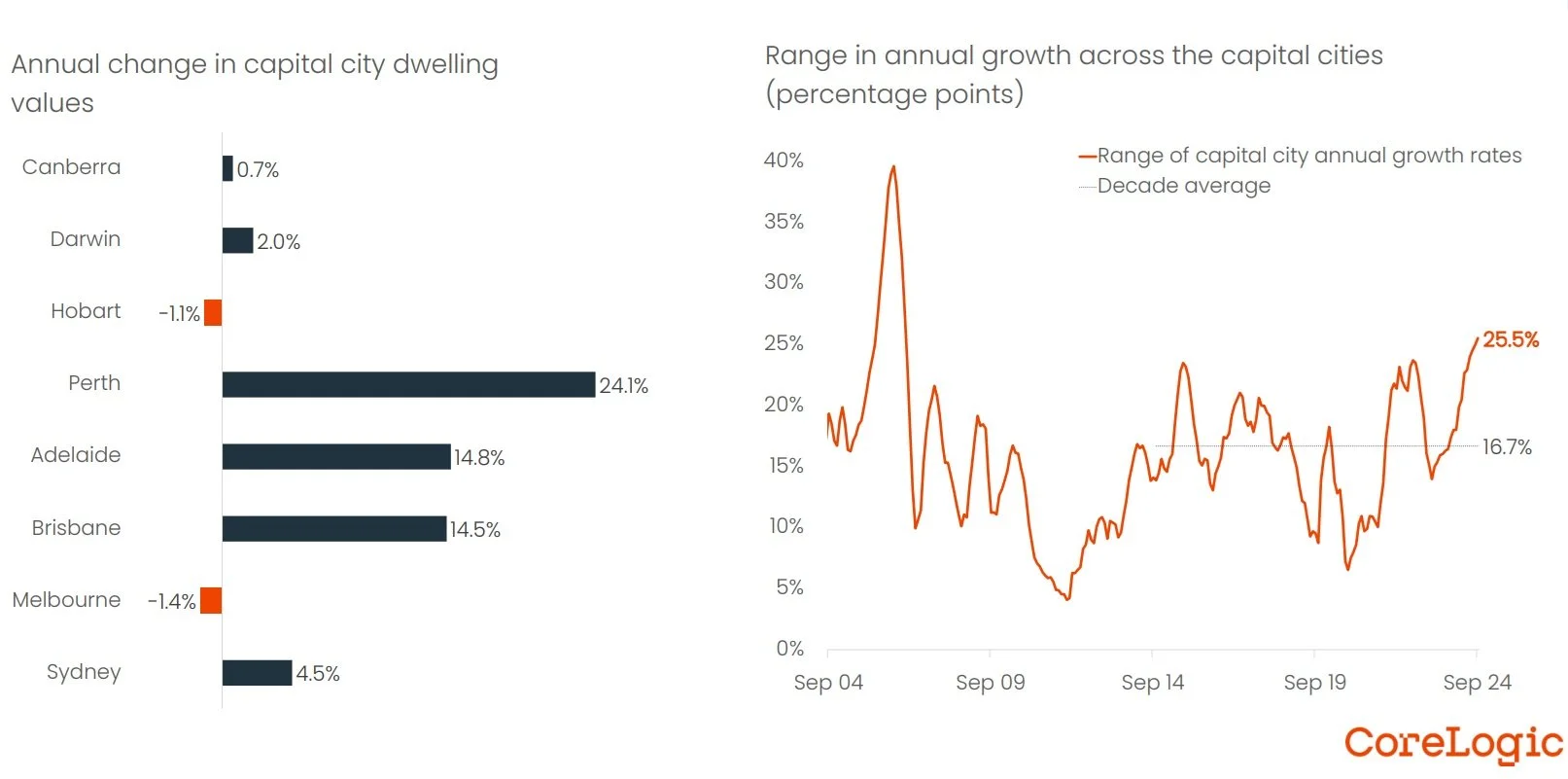

According to CoreLogic’s Tim Lawless, national home values have risen by 14.3% over the last 20 months, despite high interest rates and cost of living pressures. However, the pace of growth has slowed, and there’s increasing diversity across regions.

For instance, Perth saw a 24.1% rise in dwelling values, while Melbourne experienced a 1.4% decline, over the last 12 months. Understanding these regional trends is essential when making housing decisions. Mr. Lawless highlighted the importance of increasing housing supply, suggesting that government initiatives like concessions for developers or more public housing could help supply challenges.

As we head to an election, we will hear politicians put forward a diversity of contrasting ideas set to solve for our housing challenges, and we’ve heard some already. From First Home buyer initiatives which will help with affordability, to capital gains tax or negative gearing changes - there will be more.

Here is a copy of Tim Lawless's October 2024 presentation, which focuses on the above plus more.

Final thoughts

With the RBA expected to hold off on rate cuts until at least February 2025, strong employment figures and persistent inflation will keep variable rates steady for now. While fixed rates have seen some swings, particularly with Macquarie, deciding whether to fix your loan requires careful consideration. Especially with potential variable rate cuts on the horizon. The housing market remains complex, and while there are downside risks, low supply will offset this for now. It’s important to stay informed about trends and have access to the data if you’re considering buying or selling property. As we head into the last quarter of the year, CPI data will become available which will help shape the views of economists to understand when and how many rate cuts we could see in the next 12 months, which could boost confidence in the housing market. We will continue to stay close to this all.

Reach out to us on

0448 890 186

or

Send us a quick online enquiry by clicking the START TODAY button