RBA holds: Impacts on borrowers and forecasts

The Reserve Bank of Australia (RBA) Governor Michelle Bullock delivered the fourth press conference of the year last week, deciding to once again hold the cash rate steady at 4.35 per cent. The RBA made clear they are only considering holding or rate hiking at the moment. Despite this high rate environment and increases in business insolvencies, property prices continue to increase off the back of extremely low supply. Forecasts for rate cuts are now pushed out, and broadly agreed to happen at the end of the year, or in early 2025. Government spending from the federal and state budgets, about to filter through to the economy and our property market in particular, further cement this view of rates being on hold for longer. One economist believes we are likely to see a rate increase in August this year and he’s one that is regarded as the best in the industry – not what us borrowers want to hear.

Our uncertain and tricky to manage economy

The RBA stated in their recent press release that “it will be some time yet before inflation is sustainably in the target range”, making clear that we’re not on top of the inflation problem yet and they remain committed to do whatever is necessary to bring inflation down to meet their 2-3 per cent annual inflation target.

Predictions from the experts

Lead economists from NAB, CBA and Westpac, despite these warnings from the RBA, still believe we will see a cash rate cut in Nov 2024. CBA’s Gareth Aird stated, “there’s a real risk in the near term that the inflation print is uncomfortably high”. He is referring to the next quarterly Consumer Price Index (CPI) number which is released on 31 July. “What would get them (RBA) to hike is if core inflation comes in above their 1 per cent forecast. We think .9 per cent or below but if you get north of 1 per cent on the headline inflation rate for a quarterly change, that’s really going to test their tolerance.”

As we know, inflation is measured by CPI, and if items within this measure such as rents, insurance premiums, cost of building a home continue to be sticky, and the CPI number is near or over 1 per cent, CBA’s economist says, “there will be a lot of pressure on the RBA to raise rates.”

ANZ, has shifted their view of when rate cuts will start, believing the economy won’t prove to have slowed enough for the RBA to cut rates in 2024, and has pushed out their prediction, until February 2025. Judo Bank’s lead economist, Warren Hogan, who’s predictions were most accurate in 2023, believes the economy is way too hot at the moment and has made a bold call that the RBA will actually raise rates in August 2024 when they next meet.

Government spending and it's impacts

When the RBA said in it’s statement “recent budget outcomes may also have an impact on demand” it was talking about the government spending, and it’s concerns for the economy.

Cost of living relief measures, while of course necessary given how tough it is at the moment for a lot of Australian’s, also then adds to demand. Electricity rebates and tax cuts for example, will inject money into the economy. Tax cuts also enable higher borrowing levels, as referred to in last month’s update. AMP’s economist Shane Oliver makes his point on the matter, explaining that while these government actions to inject money into the economy are popular with voters and important given the times, they unfortunately do prolong higher interest rates.

Increased insolvencies

Higher interest rates is causing consumer demand to fall and as a result, we’re seeing insolvencies for Australian businesses reach record highs. Data from CreditorWatch shows an average increase in the rate of insolvencies of 38 per cent over the year to May 2024, across all industries.

Seeing the trends above and given the economic conditions, even with government stimulus, it’s hard to see these trends reverse without rate cuts.

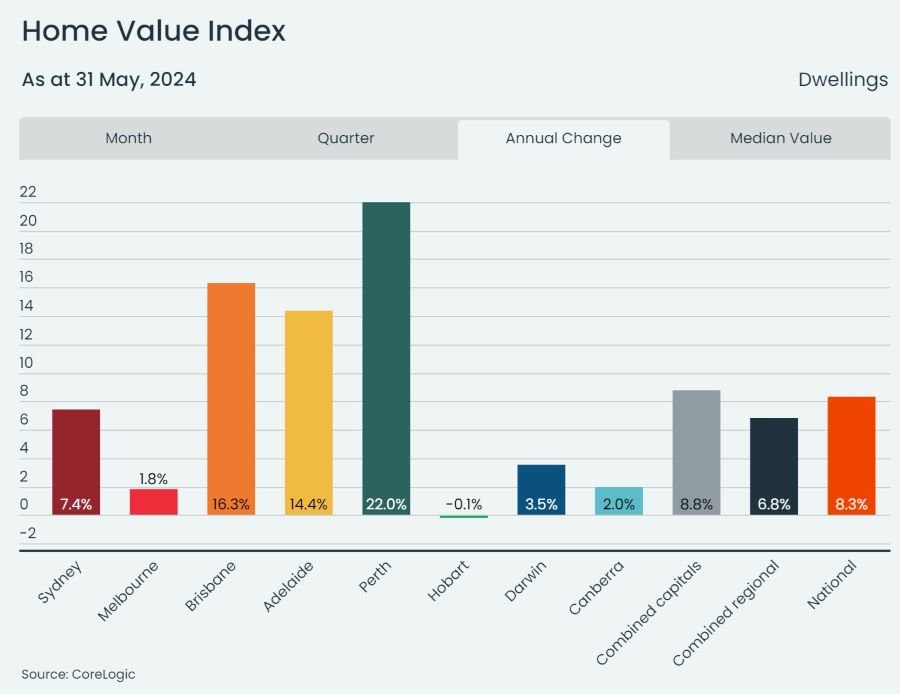

Even dwelling values are up over the year, nationally.

Corelogic’s research director, Tim Lawless has stated that this rise nationally, is simply a result of low levels of supply across the market. “Inventory levels in these markets remain well below average despite vendor activity lifting relative to this time last year. Fresh listings are being absorbed rapidly by market demand, keeping stock levels low and upwards pressure on prices.”

With businesses doing it tougher, you’d think to see unemployment rise but we haven’t seen this as of yet. The labour market is still relatively tight and people can afford to borrow money to buy property and this is reflective in the data above.

Final thoughts

Inflation is being stubborn and the government stimulus measures, according to the experts and even the RBA, could cause the problem to get worse. Some economists have pushed out their forecasts for rate cuts at the start of next year, with the risk of an increase beforehand. It will be interesting to see how the property market performs as the year progresses but given the current trends and low supply, it doesn't look to be losing any steam soon. The uncertainty around the economic trajectory is making financial decisions somewhat uncertain for some but the closer we stay to the data, the more informed we can be to make a decision that is in our best interests. All of this makes for an environment where the borrower needs sound, objective and well informed general advice.

Reach out to us on

0448 890 186

or

Send us a quick online enquiry by clicking the START TODAY button

Feedback

We’d love to hear what you think about our content or how we could improve to make your experience better. Please send a note to peter@blackandwhitefinance.com.au to let us know your thoughts.