What to do with your mortgage now

We're now even more likely to see interest rates stay steady, for longer. Again, we’ve seen higher than expected US inflation numbers, so the fear amongst some is that the same is likely to occur here in Australia. If we combine our data sets such as unemployment, wages, and rents, you can see that we’re just not cooling fast enough for rates to come down soon. Economists are suggesting we will see rates come down, at the end of the year so we're generally advising to stick with variable rates for now. If you can afford these high repayments, or have equity in your existing property, the setting is somewhat positive from an investor's perspective given high population growth and high rents.

The US economy is still too hot

As we highlighted in last month’s update, the US economy is again, still too hot. The month-on-month US inflation reading, rose 0.4 percent in March, according to the US Bureau of Labor Statistics. Key drivers of this inflation were rents and services.

This figure was now the third straight month where US inflation tracked above expectations. Their low unemployment rate is pushing wages higher too. It’s making clear that inflation is proving hard to get on top of, prolonging or pushing back the likelihood of their central bank cutting rates any time soon.

Australian rates to hold

We have similar challenges in our local economy with low unemployment and high wages (see below). ANZ believes the first interest rate cut from the Reserve Bank of Australia (RBA) will come in November 2024. Money markets and economists who predicted mid-year rate cuts here in Australia were too optimistic.

AMP’s economist, Dr Shane Oliver, on the other hand, believes we are different to the US economy, and we will see earlier rate cuts in August or September 2024. He did add the disclaimer that inflation could prove stickier than expected.

While the US and Australian economies share a lot of similarities, they are somewhat different too, which is why he’s backing this earlier rate cut expectation. Dr Oliver believes that the US economy's inflation figures have rents contributing a significant weight to the overall figure. Something close to 35 per cent in comparison to Australia where it’s only about 6 per cent as a contributing factor. “Even though rents are rapidly rising here, they’re not going to have anywhere near the same effect they have in the US”, Dr Oliver said.

Confidence and household disposable income down

According to the Australian Bureau of Statistics (ABS), real household disposable income while ticked up a little of late, off the back of wage increases, is still very low on the whole. This shows how much pressure households are under at the moment.

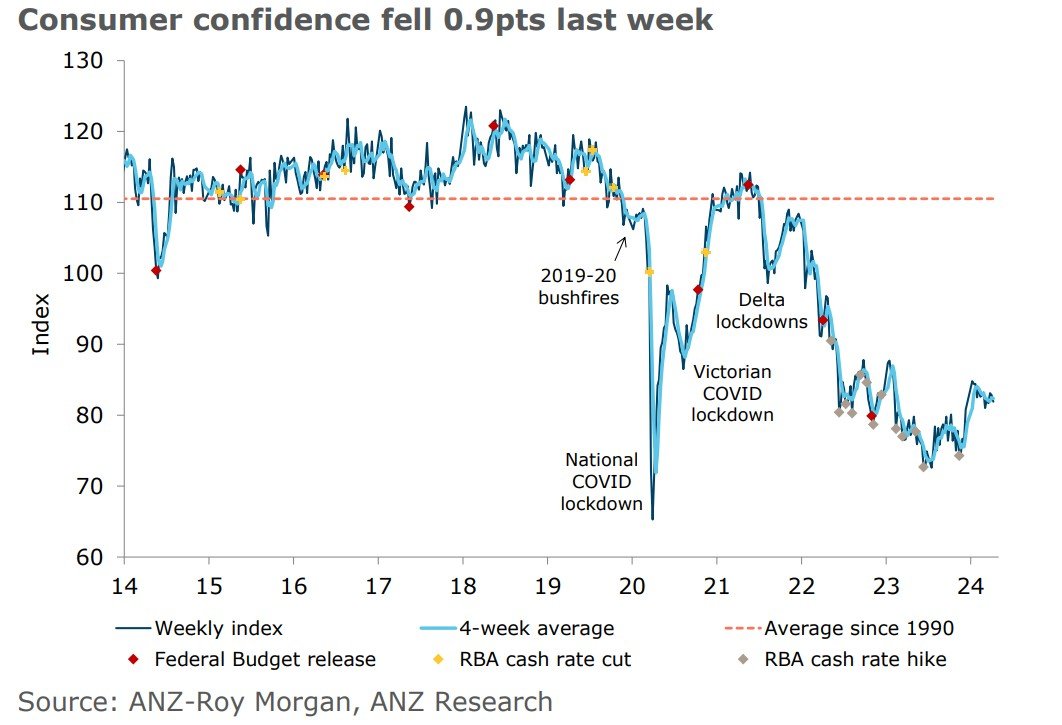

This low household savings ratio, correlates with the low consumer confidence recordings, as the ANZ-Roy Morgan survey showed. You can see that consumer confidence is at very low levels (see below).

The Westpac-Melbourne Institute measure of consumer sentiment shows a similar picture to what you see above.

ANZ’s economists raise an interesting notion about what could happen in the future when our stage 3 tax cuts come into effect from 1 July. Will consumer confidence remain low and people then save their tax cut money, or, will they go out and spend it? “If confidence was instead to remain around current levels, that would point to a much smaller pick-up in spending, with more of the tax cuts saved.”

Important dates to look out for

All eyes will be on the monthly ABS Labour Force update, due 18 April 2024 and more importantly, on the ABS March quarter consumer price index (CPI) update, due 24 April 2024. These figures will be pivotal in shaping the Reserve Bank of Australia’s view on what to do with interest rates this year. Westpac’s economist Matthew Hassan expects we will see “a clear drop in inflation”, which will be welcoming news to all Australians.

Banking strategies

If the RBA doesn’t cut rates this year, we will see a spike in missed payments, arrears, and defaults. We will likely see insolvencies elevate even further too, with small businesses finding it tough, especially in those challenged industries - construction and hospitality.

With higher rates, it’s harder to borrow money, and serviceability buffers remain the number one reason clients cannot refinance, so we will likely see more borrowers move to non-conforming third-tier lenders. There are still lenders out there helping with cash back for refinances. Lenders are still providing the 1 per cent buffers for dollar-for-dollar refinances. Other clever strategies exist, even when servicing is tight, where you can make your refinance work with the 1st or 2nd tier lenders, more so if you have equity in your property. And if you have this equity, you can use it to get creative with other strategic lending solutions. Many of our property owners fortunate to have been in the market to ride the wave of growth, have been able to utilise the equity in their homes to buy businesses, buy commercial properties, purchase investment properties or restructure into lending strategies better suited to combat the foreseeable future.

And when it comes to the future, given where we’re at in the economic cycle, we’re not looking at fixing anyone’s home loan repayments now. Once the tone from the RBA and our economists turns positive or ‘dovish’ as it’s referred to, we should then see the banks start to drop their fixed rates and then we could lock in. For now, with what we know, it’s in our best interests to remain variable. It would be a big bet to take to lock in at a fixed rate today, which is higher than our variable rates on offer. We will be watching this space closely, nevertheless.

Final thoughts

Higher than expected inflation will ultimately delay rate cuts for the US and our Australian economy. Geopolitical tensions won't help the cause either, causing more concern. Local inflation will determine what our RBA will do and as we move closer towards the end of the year, we are expected to see fixed rates start to come down. With consumer demand and confidence at all time lows, inflation figures will likely show signs that we’re cooling – so we hope.

With the banks still offering refinance cash back rebates, 1 per cent dollar-for-dollar refinance options, and being more lenient when it comes to you if you have equity in your property, there are still a lot of options out there to set ourselves up to tackle the immediate landscape or even take advantage of it. We will stay close to all of this and continue to ensure your lending solution is in your best interests to tackle the year ahead.

Reach out to us on

0448 890 186

or

Send us a quick online enquiry by clicking the START TODAY button

If you want to know more about the different rates, terms, or bank specials on offer at the moment or just have a general question, please send a note to peter@blackandwhitefinance.com.au or click the start today button a little lower. With the help of our amazing Black and White Finance team, we will be able to support you.